… Programs and Tools to Foster Financial Stability Searching our Resource Database For a … speaking taxpayers. Learn more about this program . Find a local tax assistance site. Local Resources for Financial …

Displaying 1 - 10 of 104

-

-

… Summer Camps / Activity Programs When school ends in June, parents are looking for … often occurs in early spring. Some camps offer financial assistance and open houses to learn more. … through over 900 summer camps throughout the state. Find a local summer camp. Summer Camps for Individuals with …

-

… Nutrition Programs for Senior Citizens Programs Providing Meal Services … to get their own nourishment may be eligible for the local Meals on Wheels program. The Area Agencies on Aging, … to find out what is available in your area or find your local County Agency on Aging here . Privately Funded …

-

… Water Bill Assistance Programs New Jersey American Water (NJAW) - NJ SHARES … monthly bill, depending on eligibility. For both programs, an applicant's income must be no greater than 300% … Information, call 609-883-1626. … /water-bill-assistance-programs … Water Bill Assistance Programs …

-

… State Housing Assistance Programs Start with the DCAid Screening Tool DCAid is a great … Homeless Prevention Program This program provides limited financial assistance to low and moderate-income tenants and … more about applications and eligibility here . Find your local Habitat for Humanity here . Related pages Related …

-

… Other Utility Programs that May Help Comfort Partners Comfort Partners is … out an electronic application with the assistance of a local community-based organization. Applications are taken by … Applicants Must: Reside in New Jersey Be experiencing a financial crisis, such as a job loss or illness Be behind on …

-

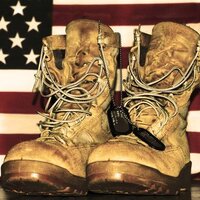

… State and Local Resources for Military Personnel and their Families For … Picatinny Arsenal AC S provides employment services, financial readiness, and emergency financial relief … military home buying, retirement, and more. Local Housing Programs and Homelessness Prevention Housing assistance is …

-

… Understanding and Accessing Public Healthcare Programs Accessing affordable healthcare is important to all … the state and seniors are no exception. State and federal programs are in place to assist you. Medicare and Medicaid … that is paid for through the Medicare program. Find your local FQHC here. Medicare Rights Center Further help in …

-

… Local and County Resources for Military Personnel and their … Community Hope ’s Hope for Veterans Community Hope’s programs for veteran’s address homelessness, mental illness, … abuse treatment, child care and job training. Temporary financial assistance may also be available to help with such …

-

… Holiday Assistance Programs Searching the NJ 211 Resource Database for Holiday … food or gifts this holiday season may find relief from local resources. When searching the NJ 211 Resource Database … 5, 2022, Burlington County residents can apply for financial assistance towards buying holiday gifts. To see if …